How Industry4.0 will impact the future of finance, banking, fintech, blockchain, crypto, and NFT? A keynote speech I have been delivering at many finance and fintech summits and conferences lately.

CFO and Controllers Magazine have published this interview in Dutch about it. Here you can read the translated interview:

Companies of the future have a trend-driven innovation culture. Companies stuck in traditional models are disappearing, jobs are transforming, AI is taking over (parts of) jobs, and technology is shaking up the entire financial industry.

Companies are racing to the stock market like never before and cashing in record prices. The boom has been fueled by a deluge of cash that central banks have pumped into the economy during Covid-19. Yes, politicians are very bad entrepreneurs.

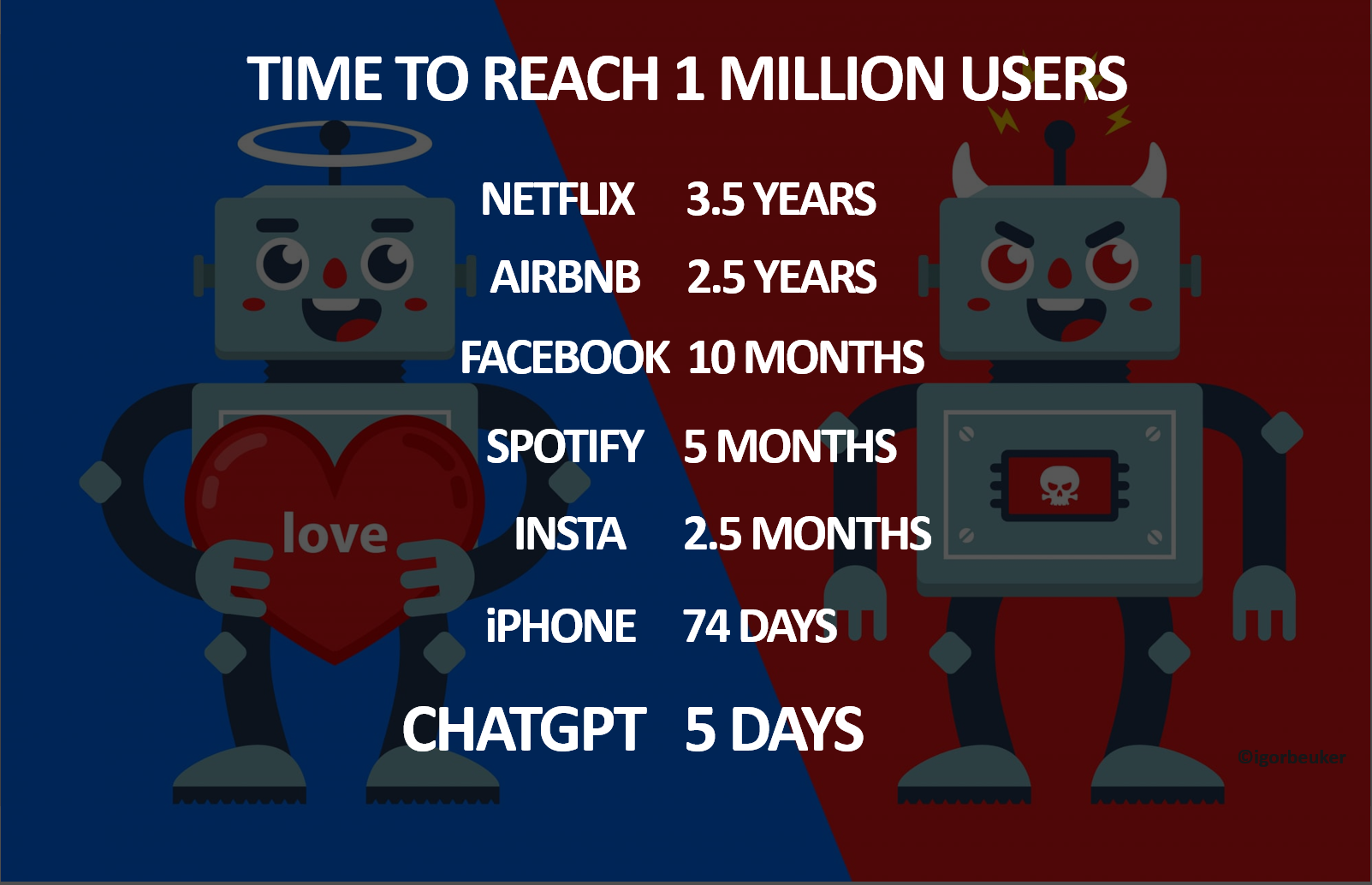

We also saw the rise of individual investors eager to buy some of their favorite companies. New fintech players are becoming highly significant players more often and faster.

They are now being bought at an earlier stage by a ‘buy not make mammoth’ or a big tech company with financial ambitions.

An IPO is now also made relatively quickly. The market is bubbling.

Under The Hood Of Industry4.0 – Finance Will Be Disrupted Coming Decade

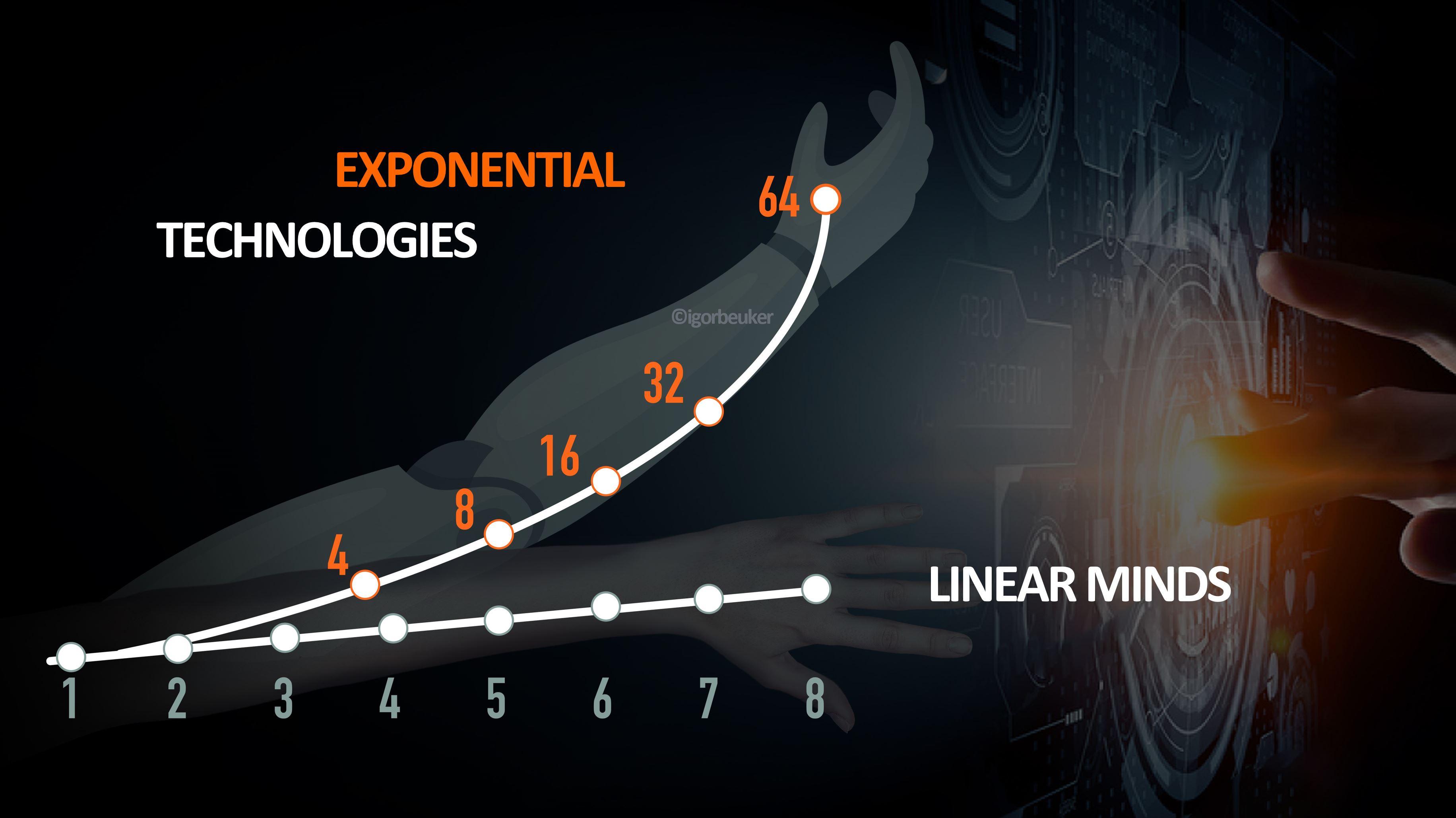

We will see the real disruption of banking and finance in the next ten years. When we open the hood of the Fourth Industrial Revolution, we see a range of exponential technologies flying out. So exponential that our linear minds can barely comprehend.

Science fiction becomes reality. In fact, Musk, Bezos, Branson are flying back2back with NASA.

Success in the future is about imagination, not being right.

It means a huge need for transformative financial services and marketing innovation strategies.

Industry4.0 already demolished the music, media, automotive, and many other industries.

CEOs in media called Netflix a hype and YouTube cat videos. But the Google-Facebook duopoly took 50% of advertising market share in 7 years’ time!

All big car brands laughed about Tesla. Who’s laughing now?

What do you think about the very traditional banking and finance industries?

Old men in suits, being delusional or in denial when it comes to digital Darwinism and disruption?

Young Investors Are Already Calling Bitcoin “Boomer Coin” – It Makes The Generation Gap Painfully Visible

Of course, for a long time Wall Street, Banks, and the SEC tried to curb blockchain, crypto, and NFTs. Power to the people, smart contracting, and transparency are changing value chains and destroying existing business models.

You can try to stop that for a while, but if you cannot beat the movement, join it! Central Banks are now also taking CBDCs (Central Bank Digital Currencies) seriously and in the US people are even allowed to participate in Stablecoins.

Young investors are already calling Bitcoin “Boomer Coin” and they are embracing Dogecoin and other Altcoins. The generation gap is painfully visible.

Digital natives have a very high willingness to purchase financial services from Big Tech players such as Amazon, Google, Apple, and to a lesser extent Facebook.

The modern digital consumer is not a king, not an emperor, but a dictator.

If screenagers don’t like your service? Then they will swipe you out of their lives for good in one go.

Artists and athletes are changing their entire business models tapping into NFTs and Tokenization.

They have learned hard and painful lessons. Don’t build your empire on leased ground. Aka Fans on Lease.

Make sure you get all your social media followers into your own channels and funnels. Use Hubspot and Mailchimp. Own your fan relation!

The time of the big tech syndicate and Fans on Lease are over. We know their walled gardens, content censoring, and squeezing of organic fan reach.

With NFTs and Tokenization, artists and athletes can offer fans immersive experiences and be part of the growth. If you can buy Nike stock, why not of your favorite artist?

Power to the people and give us back our pie!

Why Are Governments And Totalitarian Technocratic Regimes Putting Fintech On A Leash?

The SEC in the U.S. recently severely curbed blockchain and crypto. It’s also big tech’s turn, says Joe Biden. Big Tech also wants to become big in Fintech, so that will have an impact.

We see even stricter government controls on the other side of the world. In China, the Chinese Central Bank is not only putting Blockchain and crypto on the stranglehold.

Jack Ma’s Fintech company Ant was also sad to see the IPO explode. Fintech players are suddenly on the stranglehold of the state.

Power to the people and decentralization of power, of course, does not fit in with China’s vision.

In China, blockchain and crypto are seen as an extension of social credit systems and surveillance society: controlling the people.

As always, governments can make or break technology with new legislation, whether self-driving cars, blockchain, or crypto.

So if regulation soon says that autonomous cars will be banned, we will still be behind the wheel ourselves.

That is good news for the tens of millions of people who earn their living in the transport or mobility sector. They would lose their income with autonomous cars and trucks.

I predicted a decade ago that many governments would put big tech, fintech, and crypto on a leash.

In a broader scope? I explained why authoritarian technocracies would also control the Finance, Telecoms, Energy, and Media industries.

I also spoke about CBDCs and shady regimes.

Finance Out Of The Comfort Zone – The Need For Digital Leadership & Cyber Punks

The companies of the future have a trend-driven innovation culture. That means getting out of the comfort zone for the c-suite in finance. Take responsible risks and innovate.

The ‘that’s how we’ve been doing it here for twenty years’ culture is deadly in this era.

The world will change more in the next 30 years than it has in the past 300 hundred years! So do you want to be successful, survive and grow?

Then you need digital leadership and cyberpunks. In the board, in management, and throughout the organization.

The biggest challenge I see for the entire financial sector? Old-fashioned men in suits who still think in the classic hierarchical way.

Let this group switch to Amazon’s ‘Customer Obsession’ model. You can already feel it squeaking and cracking.

Moreover, customer obsession is not just listening to customers. The customer obsession is also inventing and pioneering on their behalf. That is in stark contrast to being a risk-averse or trend follower. Brands that listen, share, and care, will cultivate sympathy and brand loyalty.

CFOs also have a significant role to play here. In a different way, people will have to look at new business models and modern people.

Dare to innovate and invest. That is culture, mindset, and DNA.

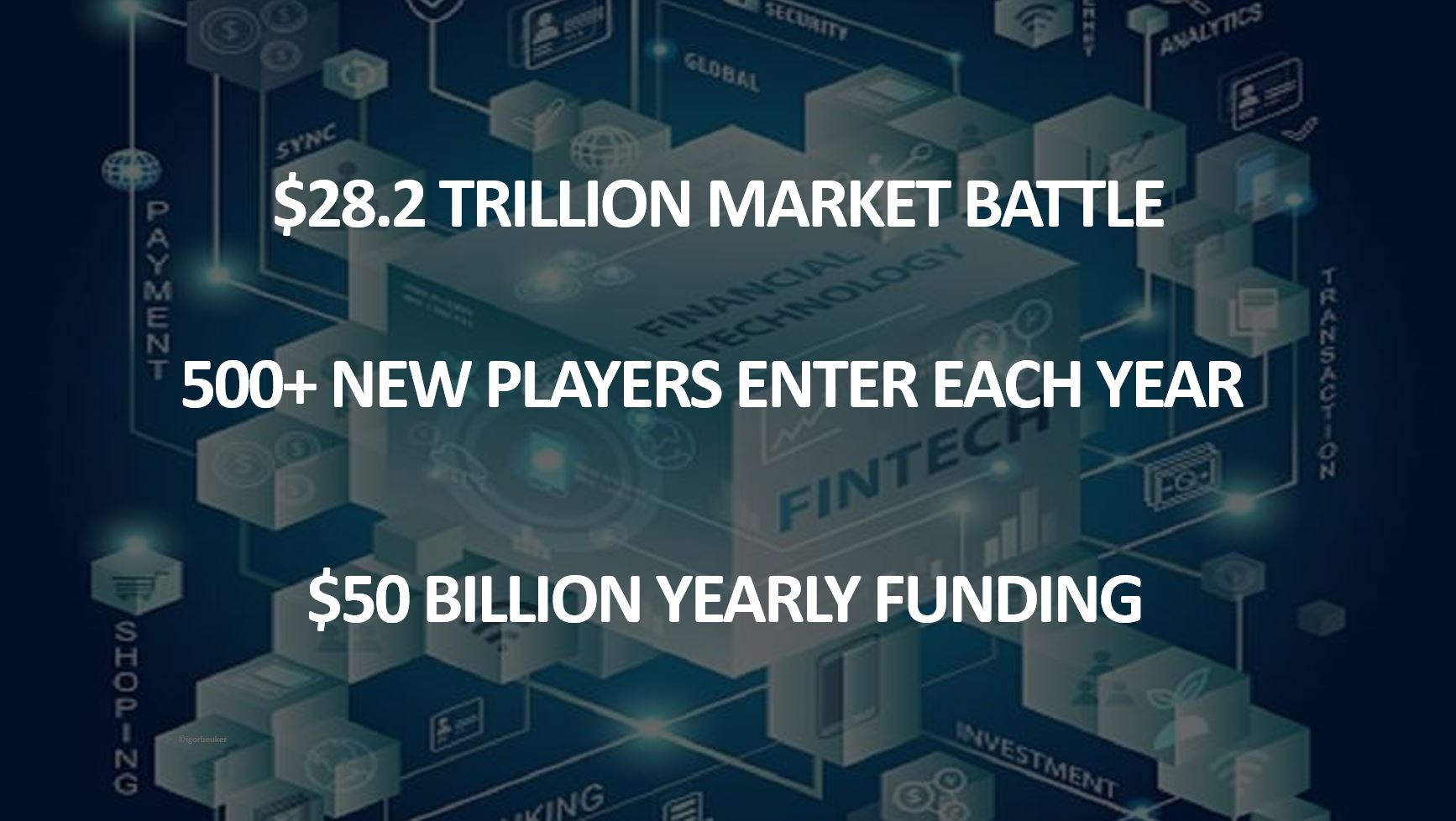

Mind you; we are talking about a $28.2 Trillion Market here!

With over 500 new Fintech players entering each year.

Call For Digital Talent & The Need For Talent Of Industry4.0

The financial sector desperately needs digital talent. And people with the skills for the Fourth Industrial Revolution: AI freaks, IoT experts, Crypto talent, and digital natives.

The big challenge here? Big Tech has been angling that talent in for a long time. With big salaries, gadgets, and a campus where you can sail in your shorts on your skateboard and then plop down in your beanbag with your laptop.

That is a lot more challenging for a young fast generation than walking around in a formal setting in a suit and tie.

After centuries of monopoly, traditional banks now have to fight for their place in the value chain. After the disentanglement of major banks, we see challengers and Neo banks, such as Revolut, Monzo, and Robinhood.

We are moving from Banking-as-a-Product to Banking-as-a-Service and soon to Banking-as-a-Lifestyle or Ambient Banking.

Legacy systems need to move to advanced and smart technology and platforms. Certainly to be able to compete with the Big Tech players.

Future Strategic Foresight & A Trend-Driven Mindset Are Paramount

Were we still giggling or haughty about those fintech startups? The numbers keep growing, and the small fish now form a large school of piranhas.

We also see several small fish grow up quickly. Every year 500+ new fintech players are added, and more than $50 billion is invested in fintech every year. Machine learning, algorithms, AI, robots, and biometric technology are becoming paramount.

As Peter Drucker put it so beautifully: ‘Culture eats strategy for breakfast.’

The financial sector is gigantic. There are many growth opportunities. But then things will have to change, and the financial industry will have to compete with the Big Tech players.

Because they want to take a big bite out of the pie. And I come from the Big Tech corner and can assure you; they will go for the whole Fintech pie!

Go Beyond Mainstream Media & Big Tech –

Get Access To My Uncensored Voice of Reason

We all know the mainstream media is often full of propaganda and bribed journalism. Big Tech makes it even worse with its content censoring, fake fact-checkers, and fading social channels to black. Should I add #fansonlease, walled gardens, and squeezing artists like lemons to the toxic social media list?

Don’t miss out! Get Math Man Magazine and my uncensored voice in your mailbox twice a month. 100% free! In my newsroom, live-on-stage action, podcasts, interviews, and more.

Read my recent article in Rolling Stone magazine about cause artists and athletes.

About the Author

In the spotlights, Igor Beuker is a top marketing innovation keynote speaker and futurist known for his foresight on trends and technologies that impact business, economy, and society. Behind the scenes, a serial entrepreneur with 5 exits and an angel investor in 24 social startups. Board member at next-level media firms, changemaker at Rolling Stone Culture Council, Hollywood sci-fi think tank pioneer, award-winning marketing strategist for Amazon, L’Oréal, Nike, and a seer for Fortune 500s, cities, and countries.

Related Posts

MONTHLY MEMBER SPECIAL