Descubra cómo la marca de ropa deportiva On, fundada por el atleta Olivier Bernhard, ha revolucionado el mercado con diseños innovadores y asociaciones estratégicas, desafiando a gigantes como Nike, Adidas y Under Armour.

La startup Suiza On se está convirtiendo rápidamente en una potencia mundial. Desde su fundación en 2010, la empresa ha experimentado un crecimiento explosivo y salió a bolsa en 2021 con una valoración de 6.000 millones de dólares.

Nos llamó la atención y la curiosidad, por eso quise investigar sobre On y compartir los resultados contigo.

¿Qué podemos aprender de On, la sensación suiza que revoluciona la ropa deportiva? En esta historia, exploraré la estrategia de marketing, innovación, comercio e influencia de On.

¡Vamos!

El nacimiento de On Running: De Atleta a Innovador

Cuando el ex triatleta profesional y seis veces ganador de Iron Man, Olivier Bernhard, se propuso crear la zapatilla perfecta para correr, inició una revolución en la industria de la ropa deportiva.

Nacida de una pasión por el rendimiento y la innovación incesante, la startup ha ascendido rápidamente de una startup suiza a una potencia mundial, desafiando el dominio de gigantes establecidos como Nike, Adidas y Under Armour.

El viaje de Bernhard comenzó con un objetivo simple pero ambicioso: crear una zapatilla para correr que proporcionara tanto un aterrizaje suave como un despegue firme.

On’s Annual Revenues Compared to Nike, Adidas, and Under Armour

How does On compare to Nike, Adidas, and Under Armour? In 2023, these brands reported the following full-year revenues in USD:

- Nike: $51.2 billion.

- Adidas: $23.4 billion.

- Under Armour: $5.7 billion.

- On Running: $2 billion.

It’s worth noting that while Nike‘s revenue is significantly higher than that of the sportswear startup, it has been experiencing rapid growth.

The Swiss Sportswear brand achieved a 55% constant currency net sales growth in 2023, which is impressive compared to Nike’s 10% growth for the same period.

On Holding AG is traded on the New York Stock Exchange (NYSE) under the ticker symbol ONON.

See the annual marketing budgets 2 chapters below.

Innovation Meets Marketing: On’s Winning Formula

On’s marketing strategy focuses on authentic storytelling and community building. The brand has partnered with high-profile athletes, leveraging their influence to showcase its commitment to performance and innovation.

These collaborations, combined with a solid social media presence and influencer partnerships, have helped the startup to create an engaged community of runners and sports enthusiasts.

The company’s direct-to-consumer approach, with a growing emphasis on e-commerce and branded retail stores, has allowed it to connect closely with its customers.

This strategy has paid off, with direct-to-consumer sales accounting for 37.5% of total revenue in 2023.

In 2003, I started the community marketing agency LaComunidad. We created communities and tribes around artists, athletes, events, and brands like Starbucks, Coca-Cola, Illy, and Nike.

One of the most funky projects was Gatorade Mission Control, about 15 years ago. See a short video clip here:

How small brands can outsmart big brands? The Gatorade community included open innovation and ALF: Always Listen First!

We called Gatorade Mission Control ‘brand programs’ or branded platforms. This is not to be compared to running an 8-week-long advertising campaign. This is long-term brand programming—think sponsoring for 3 years or more!

Sure, advertising may win a few quarters, but innovation wins decades.

In 2008, WPP/GroupM acquired the marketing agency LaComunidad.

Star Power: On’s Athlete and Influencer Strategy

On Running has developed a robust influencer and athlete strategy to complement its innovative products.

Here are some notable names in On’s athlete roster:

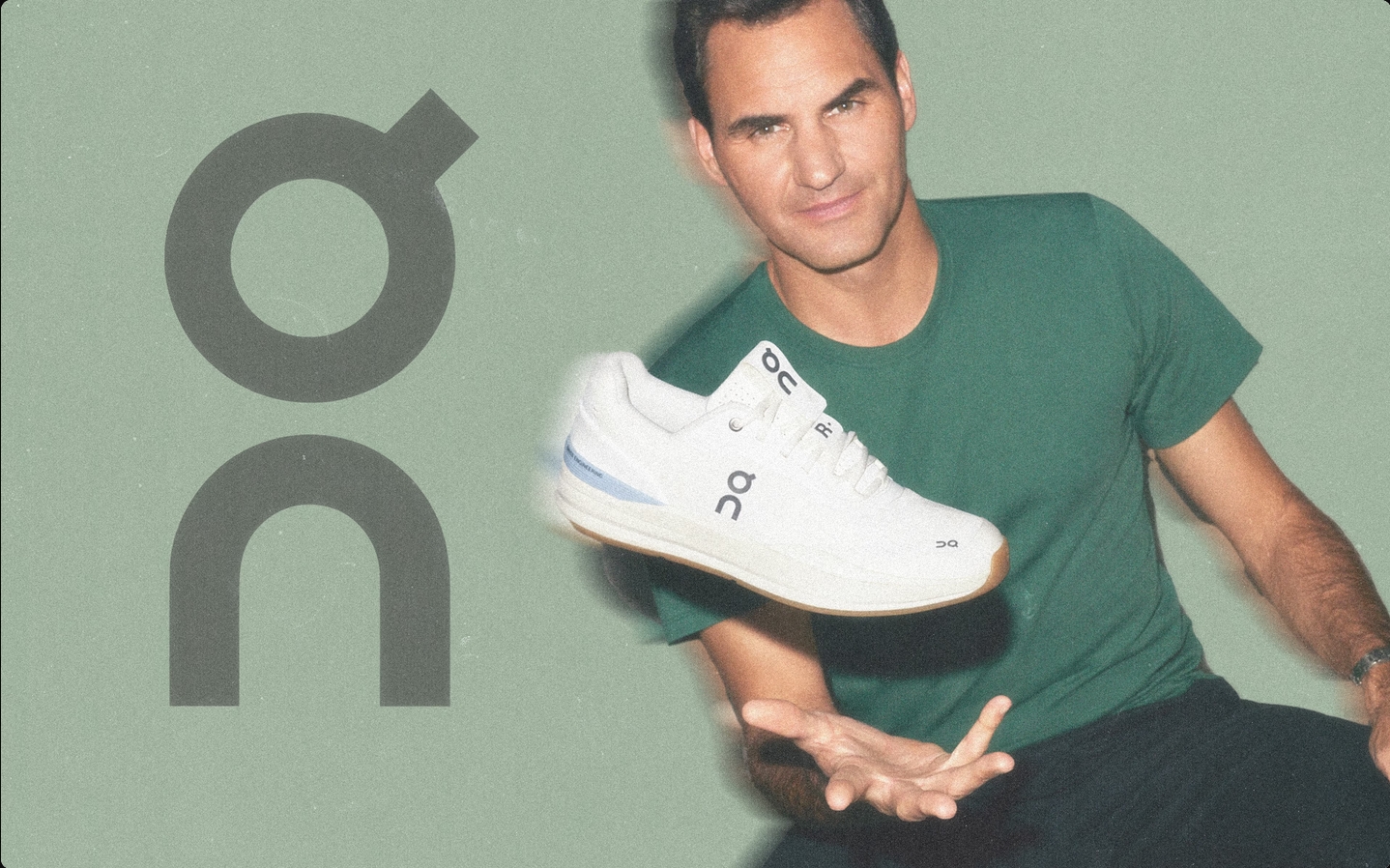

- Roger Federer: The tennis legend not only endorses the company but is also an investor in it.

- Iga Świątek: The world’s No. 1 ranked women’s tennis player signed in 2023.

- Ben Shelton: The rising American tennis star joined the roster, adding to their growing influence in tennis.

- Hellen Obiri: The Kenyan long-distance runner and Olympic medalist showcases the brand’s commitment to track and field.

- Javier Gómez Noya: The Spanish triathlete and multiple world champion represents the brand in endurance sports.

These partnerships have played a crucial role in its rapid growth and increasing market share, enhancing the brand’s credibility among serious athletes and fitness enthusiasts.

David vs. Goliath: The Battle vs. the Industry Giants

While On may not yet match the sheer size of Nike, Adidas, or Under Armour, it has carved out a unique position in the market.

Unlike its larger competitors, the sportswear startup has maintained a laser focus on running and performance wear, allowing it to innovate rapidly and cater to athletes‘ specific needs.

The startup’s growth rate outpaces its larger rivals, with the brand gaining market share in key regions.

While Nike and Adidas have struggled with inventory issues and shifting consumer preferences, the startup has capitalized on its agility and innovation-driven approach.

On’s marketing budget is not precisely disclosed, but it is fractional compared to its high-roller competitors.

For comparison, check what Nike, Adidas, and Under Armour spent on marketing in 2023:

- Nike $4 billion.

- Adidas $2.77 billion.

- Under Armour $500 million.

The challenge for CMOs is to use new technology to add new value, not just to interrupt people in new ways.

On’s trend-driven, opportunity-seizing innovation culture is disrupting the competing incumbent brands.

The Future: Sustainable Growth and Global Ambitions

Looking ahead, the startup is not content to rest on its laurels. The company has set ambitious goals for sustainability, aiming to be a leader in eco-friendly sportswear production.

With initiatives like the Cyclon, a fully recyclable running shoe, the brand is positioning itself at the forefront of sustainable innovation in the industry.

As the brand continues to expand its product line and global reach, it remains true to Olivier Bernhard’s original vision: creating performance wear that pushes the boundaries of what’s possible.

With its unique blend of Swiss engineering, athlete-driven design, and a passionate community of supporters, the brand is poised to continue its ascent in the competitive world of sportswear.

In a market dominated by established giants, the startup proves that with the right combination of passion, innovation, and purpose, it’s possible to compete and redefine an entire industry.

Olivier Bernhard’s journey from athlete to entrepreneur inspires, showing that sometimes, the most revolutionary ideas come from those who dare to dream of a better running experience.

Visit On’s website to examine its innovative CloudTec technology. Or read this piece by The Sports Edit about its Running’s Revolutionary Tech: The Science Behind the Clouds.

As the Swiss startup continues to make waves in the sportswear industry, one thing is clear: this sensation is just getting started.

Whether you’re a professional athlete or an everyday runner, the brand’s commitment to innovation and performance reshapes the future of athletic footwear.

What’s your future vision for On? Let us know in the comments.

On’s Growth Channels, Regions, and Product Categories

Since the sportswear brand is publicly listed, we can find specific sales figures in its annual report. Based on the search results and the information provided in On’s financial reports, here are the key sales figures for 2023:

Approximately $2.1 billion in total annual revenues, representing a 46.6% increase from the previous year, or 55% growth on a constant currency basis.

Sales by channel:

- Direct-to-consumer (DTC) sales: $794 million, up 50.9% from 2022

- Wholesale sales: $1.3 billion, up 44.2% from 2022.

Sales by Region:

- Americas: $1.4 billion, up 52.2%.

- Europe, Middle East, and Africa (EMEA): $577.8 million, up 29.2%.

- Asia-Pacific: $166.8 million, up 75.9%.

Sales by product category:

- Shoes: $2 billion, up 46.6%.

- Apparel: $81.4 million, up 45.5%.

- Accessories: $14 million, up 60.7

E-commerce net sales: $540.7 million.

Get Access To My Uncensored Voice of Reason

We all know the mainstream media is full of propaganda and bribed journalism. Big Tech makes it even worse with its content censoring, fake fact-checkers, and fading social channels to black.

Should I add #fansonlease, walled gardens, and squeezing artists like lemons to the toxic social media list?

Subscribe to Math Man Magazine – my uncensored voice of reason – in your mailbox for free!

In my newsroom, you can see me in action with Sir Richard Branson, Novak Djokovic, and Max Verstappen. Here, you can also watch interviews, podcasts, and backstage content.

About the Author

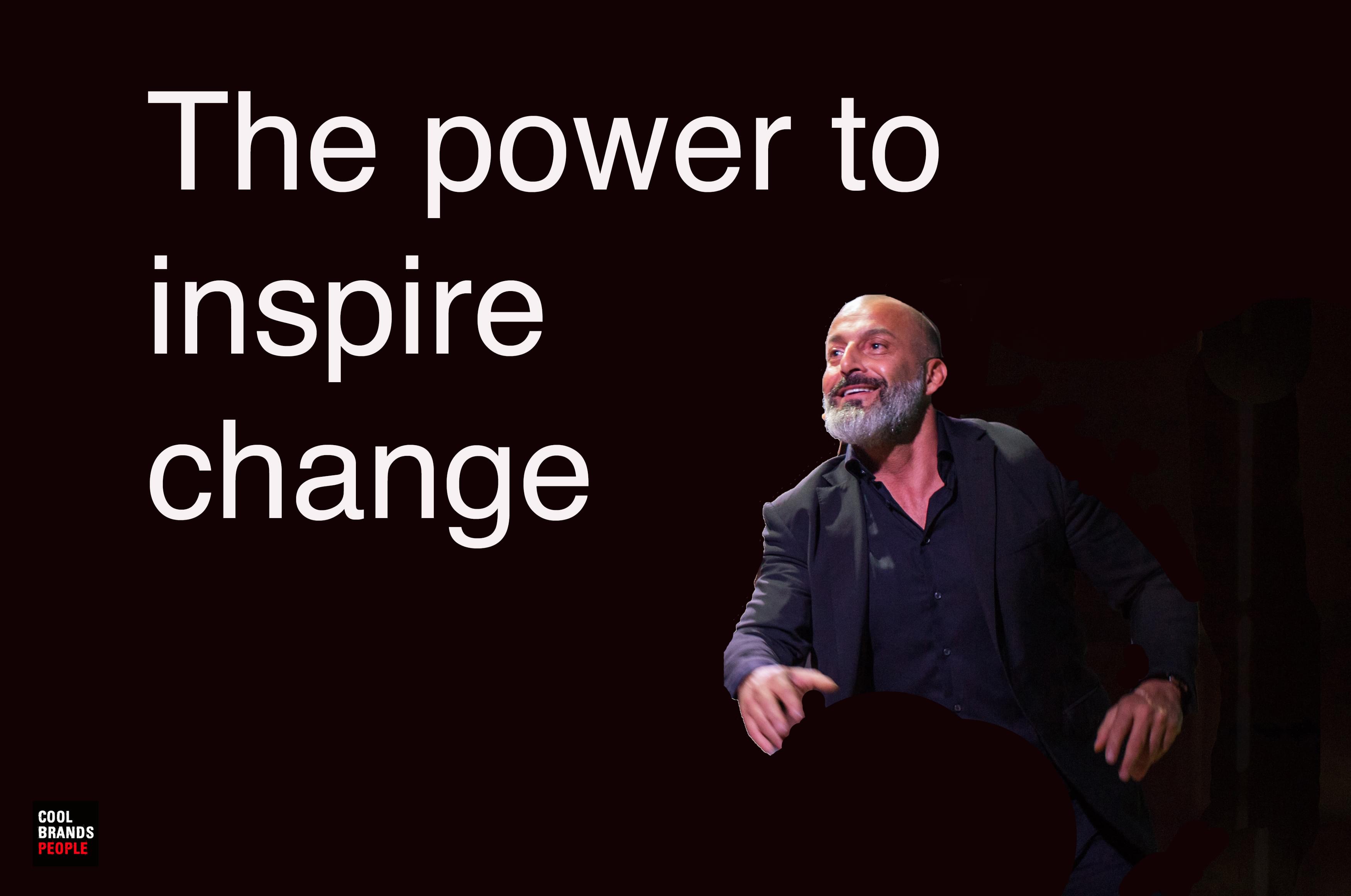

In the spotlights, Igor Beuker is a top marketing innovation keynote speaker and futurist known for his foresight on trends and technologies that impact business, economy, and society. Behind the scenes, a serial entrepreneur with 5 exits and an angel investor in 24 social startups. Board member at next-level media firms, changemaker at Rolling Stone Culture Council, Hollywood sci-fi think tank pioneer, award-winning marketing strategist for Amazon, L’Oréal, Nike, and a seer for Fortune 500s, cities, and countries.

Artículos Relacionados

OFERTA ESPECIAL MENSUAL PARA MIEMBROS